Why Real Estate Remains a Safe Bet—Even in a Recession

And Why Northwest Florida's Market Doesn't Compare to the Rest

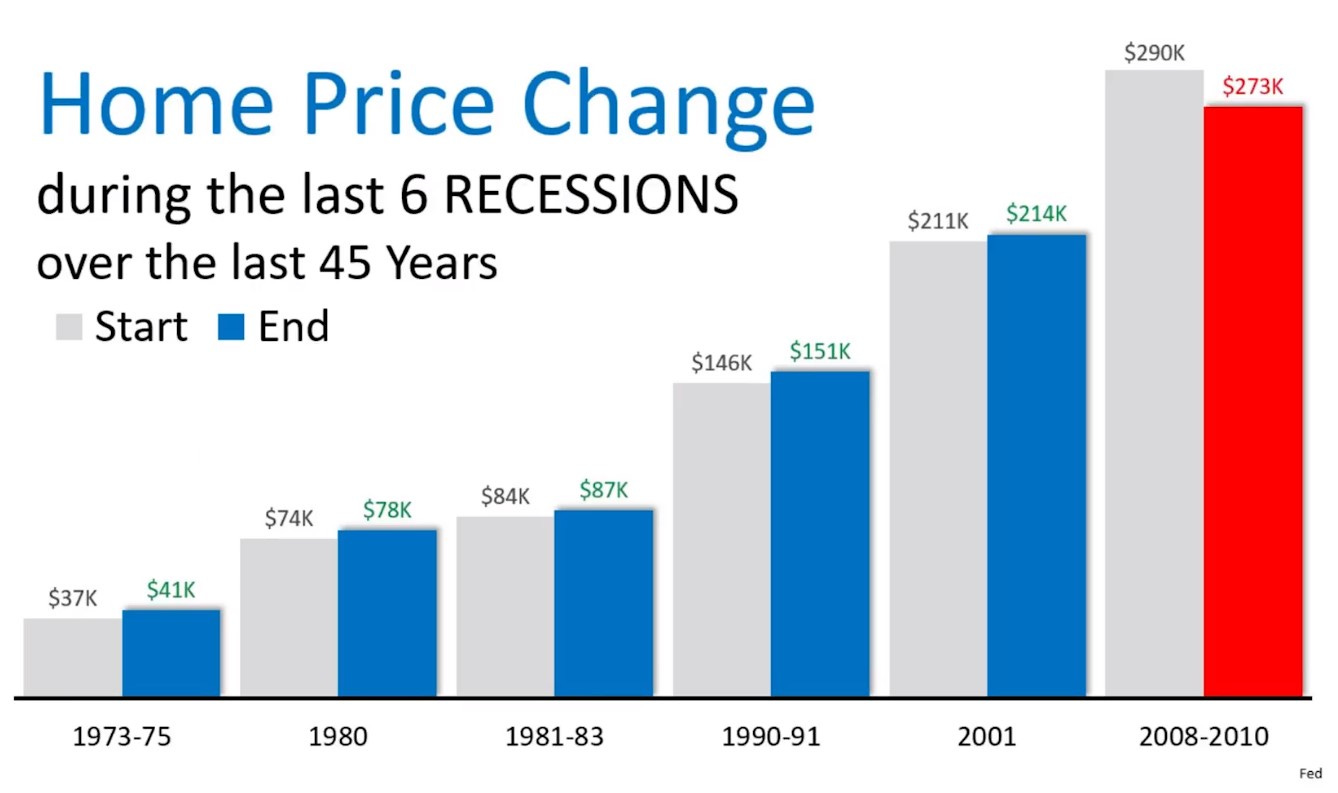

When the word “recession” starts popping up in headlines, many investors get nervous—and understandably so. Stocks swing wildly, corporate hiring slows, and consumer confidence drops. But one asset class continues to prove its staying power: real estate.

Here’s why real estate remains one of the safest investment vehicles during economic downturns—plus how certain niches like multifamily and military markets can offer even greater protection.

1. Housing Is a Basic Need—No Matter the Economy

Unlike other assets, real estate fulfills an essential human need: shelter. I strongly believe that any investor should have a diversified portfolio, but if stocks or bonds take a dive, then all you’re left with is a piece of paper saying what something is worth. With real estate, the short term economy doesn’t affect the value of a piece of real estate as drastically because people still need a place to live. So, while that property may not be worth as much as it once was thought to be worth, at least it can still serve a purpose and you have a tangible product that can be used as a tax write off and income producing asset. It is also important to note that real estate is always hyper local. So drama in the macro-economy may be completely different from what is happening in your region, local market, or even your neighborhood!

Another thing to note is that recessions often push more people into the rental market. Those who might otherwise buy, choose to rent, and those in higher-cost homes may downsize—creating new demand for more affordable housing options, making it recession-resistent. (This is one strategy that my husband and I use when we buy investment properties. We choose not to be in the luxury market, because there will always be demand for more affordable options)

2. Multifamily Properties Provide Cash Flow and Flexibility

If you’re able to find multifamily options (duplexes, triplexes, quads, or apartment buildings), these properties can offer stronger cash flow and less risk compared to single-family rentals. With multiple units, if one unit becomes vacant, you still have income from the other unit(s) to help cover expenses. As an added bonus, duplexes, triplexes, and quads all qualify for residential home loans (vs. commercial loans). This means easier financing options, but also, if you plan to live in one unit, you can purchase it as a primary residence using a VA, FHA, or Conventional loan while taking advantage of lower down payments, lower interest rates, and additional tax benefits!

The major benefit to multifamily homes and small apartment complexes is that they allow for more scalability and more debt coverage - there are more people to cover your expenses, so you can still be making money even if there are multiple vacant units. During a downturn, smaller or shared living spaces often become more attractive due to the decreased cost of living expenses for a tenant, which increases demand for well-managed multifamily rentals which in turn could increase rents and the value of the property.

3. Military Markets Offer Built-In Stability

The major advantage that Northwest Florida has over many other areas is our proximity to so many military installations. Between Eglin AFB, Hurlburt Field, Duke Field, NAS Pensacola, the EOD School, and the (eventual) reopening of Tyndall AFB, the majority of the Florida Panhandle has a bit of a safety net for home prices. Properties near military bases have an added layer of security in uncertain times because active duty service members often relocate every 2–3 years, and their housing needs don’t pause for a recession. Many receive Basic Allowance for Housing (BAH), which guarantees a certain level of rent payment, and especially in our area, the strategic location and facilities that we have safeguard against a base shutting down suddenly.

Northwest Florida’s desirable location, predictable demand, and reliable rental income is what makes a lot of people want to buy homes and/or investment properties in our area. They know that even if they move out of the area, whether they plan to eventually move back or not, their investment in a home is a strong one. Plus, military markets often benefit from surrounding infrastructure like hospitals, schools, and government jobs—all recession-resilient industries.

4. Real Estate as a Hedge Against Inflation

Recessions and inflation often go hand-in-hand. The good news? Real estate has historically served as a strong hedge against inflation. As the cost of living increases, rents and property values typically increase—which means your investment continues to hold (or grow) in value, even as the dollar weakens.

Another perk is that your mortgage will stay the same (with slight adjustments for insurance and taxes) while rents and property values will increase. In Florida, if you claim a home as your primary residence, the assessed value of your home can only increase by 3% year over year, or the inflation rate, whichever is lower. That means, that if inflation rate was 5%, the assessed value would still only increase 3% from the previous year. Capping out at 3% year over year over year is a major perk of homeownership in Florida! (Let alone the Portability that can be transfered when you buy another homestead in Florida!).

If a property isn’t your homestead, then unfortunately there is no cap on the adjusted assessed value, but the increase in property taxes or insurance could help with your income taxes as well as justifying rental increases.

5. Less Competition = Better Deals

A slowdown in buyer activity during a recession can actually work in your favor. With fewer people in the market, you’ll have more negotiating power, access to off-market deals, and sellers who may be more flexible on terms. We have been seeing this quite a bit in our market over the last few months. Buyers have been uneasy about the economy, the election, the interest rates, the sky falling down tomorrow, and everything else! That uncertainty has allowed for a build up of inventory and less buyers willing to step forward. Buyers that are looking at the broader picture of “can I still afford this home, even with the current market” are taking advantage of $1,000s of dollars worth of incentives from sellers, which is keeping cash in their pockets!

This environment can be especially favorable for investors ready to expand their portfolio, particularly in markets with strong fundamentals.

I understand that life (and buying a property) isn’t all sunshine and rainbows. So let’s also discuss the risks…

1. Higher Vacancy Risk

In a softer economy, some tenants may struggle with rent or downsize unexpectedly. This is why investing in higher demand segments like more affordable housing or military markets can be so strategic—they tend to maintain stable demand even when the economy slows. However, if you’re buying in an area that isn’t as stable, or there’s an unexpected shift, this can still be a problem. Just know there is always a solution and working with your current tenant (as long as they’re reasonable and willing to work with you) is generally going to be the better (and cheaper) option. Keeping a tenant in place, even at a slightly lower rate, is usually more financially beneficial than replacing a tenant. For more explanation on why, feel free to reach out to me!

2. Tougher Financing

Lenders often tighten their standards during a downturn. Be prepared with strong credit, solid reserves, and a well-structured deal. Creative financing and partnerships can also help you stay agile when traditional loans are harder to secure. Right now, we are seeing higher interest rates and possibly even stricter requirements for credit scores, employment, and rental profitability, but if you are willing to be creative in the financing, deals can still get done!

Final Thoughts

While no investment is completely recession-proof, real estate has consistently outperformed in the long run—especially when investors focus on high-demand, stable niches, and buy within their means, no matter what is happening in the economy.

If you're thinking about investing in a more recession-resilient way, I’d be happy to help you strategize and find the deal(s) that work best for you in your current situation. Let’s talk about how to reach your real estate goals, even when the market gets a little bumpy!

Jennifer Wilson | Realtor and Real Estate Investor | jenwilson2@outlook.com