2025 Real Estate Predictions vs. Reality

How Do The Experts Stack Up Against Their Own Forecasts

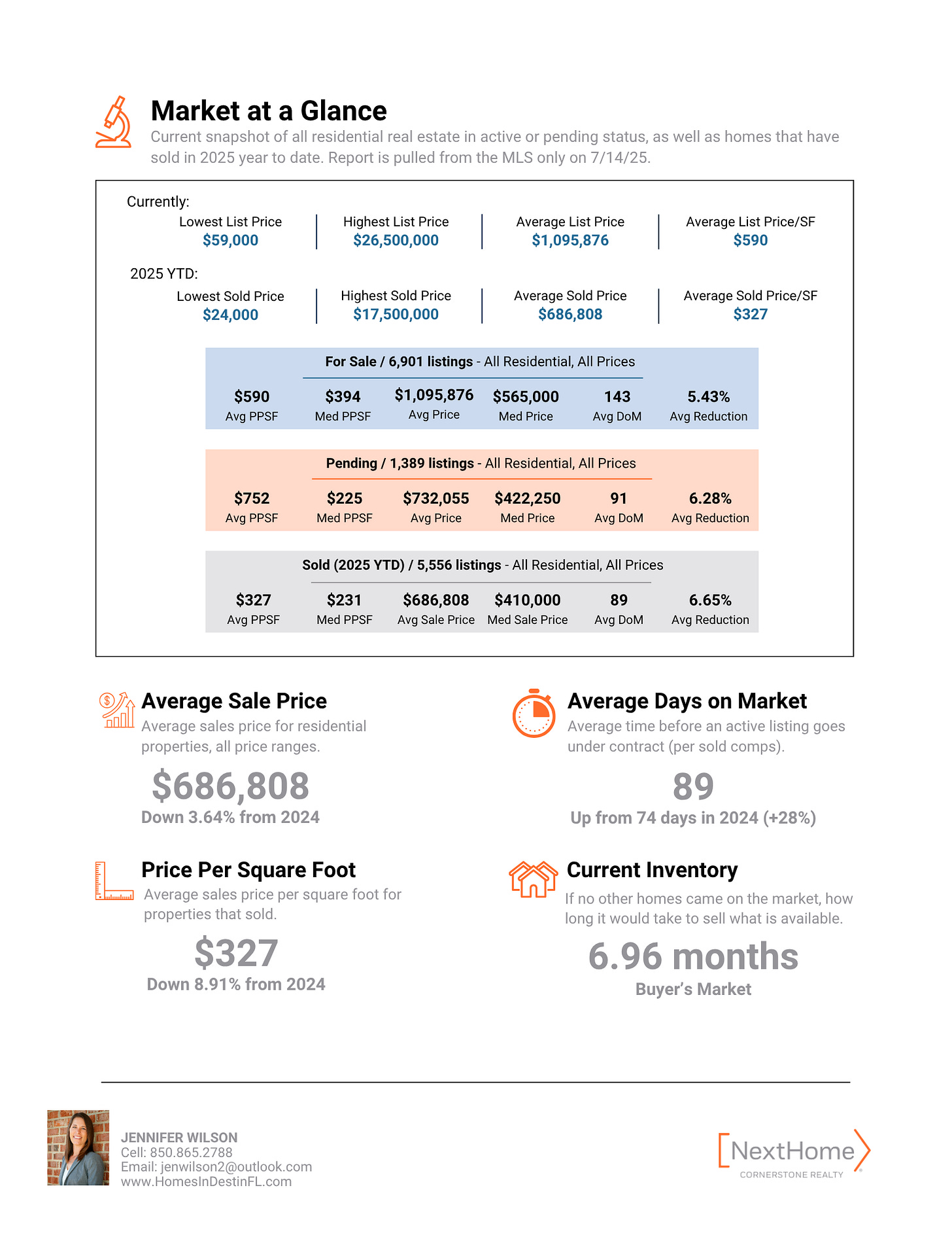

The above stats are for properties listed and sold in the Emerald Coast Association of Realtors MLS along the Florida Panhandle.We all wish we had a crystal ball to see what’s coming next. While that’s not possible, many economists look to the past to forecast the future. They’re not completely off base—but they’re not always spot‑on either.

This isn’t a knock on economists (I couldn’t do what they do, and I have a lot of respect for them). But I do think it would be interesting to take a look back at some of the predictions made in December 2024 and see how they’re lining up with the reality of the 2025 real estate market.

Home Values…

Predictions:

Zillow - decrease 2.6%

Fannie Mae - increase on average 3.6%

Mortgage Bankers Association - increase 1.5%

Looking at the data from my MLS (Emerald Coast Association of Realtors), comparing the first two quarters of 2025 to the same period in 2024, the average sales price has dipped by about 3.64%. That drop isn’t exactly welcome news—but we also need to take it with a grain of salt. After all, you can’t perfectly replicate last year’s sales with the exact same number of homes sold at the same prices.

What’s interesting, though, is that since December, the average list price has been steadily climbing each month. So, what does that really mean?

Year‑to‑date sales for 2025 are down about 6.6% compared to last year. But when you dig deeper, a big part of that decline comes from fewer units selling in the higher‑end “luxury” price points. In other words, there are more high‑priced homes sitting on the market (which pushes average list prices higher), but fewer luxury properties are actually closing this year compared to last.

Interest Rates…

Predictions:

Zillow - Rates to remain volotile - up, then down, then up again

Fannie Mae - Rates to be 6.4% by Q2 and 6.2% by end of year

Mortgage Bankers Association - Average interest rate of 6.4%

If Fannie Mae’s prediction had hit the mark, we probably would’ve seen a stronger start to 2025 than we actually did. Buyers are slowly easing back into the market as they adjust to today’s interest rate environment, but plenty are still waiting on the sidelines hoping for better rates.

Zillow played it safe by saying rates would continue to fluctuate—and technically, they weren’t wrong. Rates did increase from December into January where they hit their peak at 7.04%, but thankfully they haven’t climbed any higher that that and have been going up and down between 7.04% and the low of 6.62% on April 10th. Those numbers might not look drastic at first glance, but here’s what they mean for the principal and interest payment on a $450,000 mortgage:

7.04% = $3,006

6.62% = $2,880

6.72% = $2,910

Even small shifts in interest rates can make a noticeable difference in monthly payments.

The Federal Reserve doesn’t set mortgage interest rates directly—but the market often reacts ahead of Fed meetings and decisions on cuts. Because of that, a lot of people watch the Fed closely to gauge how the market might move.

At the end of last year, plenty of economists and real estate experts predicted we’d see Powell make 6–8 rate cuts in 2025. As of June, we haven’t seen a single one.

If you’d like a deeper dive into why that is, check out my previous Substack article here.

Buyer or Seller’s Market…

When the predictions were made, Zillow noted that we were still in a seller’s market—but expected that as inventory kept climbing, we’d shift into a buyer’s market. A pretty safe bet, honestly.

The way we determine the market type is by dividing active inventory by the number of homes sold in the past month. Anything under 5–6 months of inventory is considered a seller’s market, anything over 6–7 months is a buyer’s market, and that middle ground is what I like to call a “balanced” market.

In our area, the list‑to‑sale price ratio has held steady around 93%–94% over the past eight months. But sellers are starting to feel the pressure—inventory is up 16% since December, and days on market are hovering between 85–100 days. Some sellers are making price reductions before going under contract, while others are proactively offering closing cost assistance before buyers even ask.

That kind of “anyway money” is a win for buyers, helping lower upfront costs, and it’s also a smart way for sellers to make their home stand out against similar listings that aren’t offering it.

Taking all of this into account, it’s pretty clear: we’re firmly in a buyer’s market right now, with plenty of room for negotiation. However, just because it’s currently a buyer’s market, that doesn’t mean houses are just being given away at a steep discount; values are still historically high. So, whether you’re looking to buy in this market or sell, now could be the ideal time to do so!

If you’re looking to make a move soon, give me a call. Let’s talk strategy!